The global cannabis market shows strong growth potential. The industry has evolved from its early days, developing sophisticated operations across cultivation, processing, retail, and ancillary services. Public companies now trade on major exchanges, institutional investors have entered the market, and professional management teams lead many organizations.

However, this sector presents unique challenges. Federal regulations in the United States create operational complexities for businesses. Banking restrictions force many companies to operate on a cash basis. State-by-state legislation creates a patchwork of different rules and market conditions. These factors make it essential for investors to understand both the opportunities and obstacles before committing capital.

Flower of the Month Subscription

|

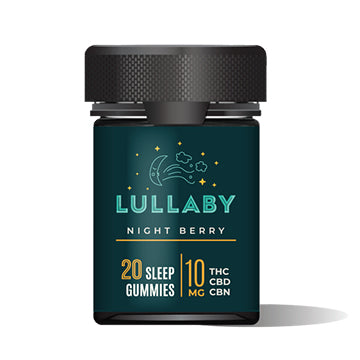

Lullaby Sleep Gummy Night Berry

|

GreeenBox Subscription

|

Investment Vehicles in the Cannabis Sector

When it comes to weed industry investments, investors have several options to consider. Let's explore each pathway in detail.

Individual Cannabis Stocks

The cannabis stock market comprises three main categories of companies:

Cultivators and Retailers

These companies form the backbone of the industry, handling direct cannabis operations from cultivation to sale. They represent the most straightforward way of investing in the weed industry Canada, though they often face the most regulatory scrutiny.

Biotechnology Companies

For investors interested in the medical aspect of cannabis, biotechnology companies offer an interesting opportunity. These firms focus on:

- Developing new medicinal cannabis products

- Conducting clinical trials

- Creating innovative delivery systems

- Researching new therapeutic applications

Ancillary Cannabis Businesses

Many investors exploring investing in the weed industry US markets find ancillary businesses attractive because these companies support the industry without directly handling cannabis. This positioning often means they face fewer regulatory challenges.

Read more: How Much Is the Weed Industry Worth in 2024?

Cannabis ETFs: A Diversified Approach

Exchange-traded funds (ETFs) offer investors a way to spread risk across multiple cannabis companies and industry segments.

Cannabis Indexes

For investors seeking broader market exposure, cannabis indexes track the performance of leading cannabis stocks. For instance, IG's Cannabis Index follows the top 20 listed Canadian and US cannabis stocks, providing a comprehensive view of market performance.

Strategic Approach to Cannabis Investment

Essential Steps for Getting Started

- Choose Your Investment Method: Before diving into weed industry investments, carefully consider whether individual stocks, ETFs, or indexes best match your investment goals and risk tolerance.

- Select a Suitable Brokerage: Not all brokers handle cannabis investments, so research platforms that specifically support these transactions.

- Conduct Thorough Research: Success in cannabis investing requires a deep understanding of:

- Company financials

- Management team experience

- Growth strategies

- Market positioning

- Risk Assessment: Understanding potential risks is crucial before committing capital.

- Start Conservative: Begin with smaller positions and scale up as you gain experience and confidence in the market.

- Maintain Portfolio Diversity: Avoid overexposure to the cannabis sector by maintaining a balanced investment portfolio.

Emerging Opportunities

The cannabis market continues to evolve, creating new investment opportunities. One interesting development is the rise of subscription-based services like monthly weed boxes. These services represent innovative approaches to market development and customer engagement in regions where cannabis is legal.

Read more: Does Cranberry Juice Help Get Weed Out of Your System?

Key Performance Metrics

When evaluating cannabis companies, particularly growers or products like cannabis subscription boxes, focus on:

- All-in cost of sales per gram

- Cash cost per gram

These metrics provide crucial insights into operational efficiency and potential profitability.

Understanding Investment Risks

Regulatory Challenges

The legal status of cannabis, particularly at the federal level in the U.S., creates unique risks for investors. This uncertainty affects everything from banking relationships to interstate commerce.

Market Volatility

Cannabis stocks often experience significant price fluctuations, requiring investors to have a strong stomach for market movements.

Valuation Concerns

The excitement surrounding the industry can lead to inflated stock prices, making careful valuation analysis crucial.

Supply-Demand Dynamics

As more companies enter the market, there's a risk that supply could outpace demand, affecting profitability across the sector.

Read more: How to Use a One Hitter for the First Time?

Investment Strategies for Success

Long-Term Approach

Many successful cannabis investors adopt a buy-and-hold strategy, focusing on companies with strong fundamentals and sustainable business models.

Active Trading

Some investors prefer to capitalize on the sector's volatility through more active trading strategies, though this requires greater market knowledge and risk tolerance.

Ancillary Investment Focus

Investing in companies that support the cannabis industry without directly handling the plant often presents a lower-risk approach to cannabis investment.

Read more: What's a Zip of Weed & Other Important Terms?

Final Thoughts

Investing definitely always requires careful consideration of multiple factors. While the sector offers significant growth potential, success demands thorough research, careful risk management, and a clear investment strategy. Whether you're interested in investing in the weed industry in Canada or exploring opportunities in the U.S. market, remember that cannabis investments carry significant risks and may not suit all investors. Always conduct thorough research and consider consulting with a financial advisor before making investment decisions.

The cannabis investment landscape continues to evolve, offering various opportunities from traditional stock investments to innovative concepts. But before you go investing and doing all that serious stuff, don’t forget to stop by our online store and see the absolute variety of products Greeen Box is excited to share with you!